Get the free statement vendor business

Show details

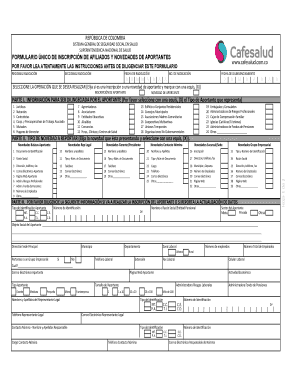

STATEMENT BY A VENDOR OF A SMALL BUSINESS Estate Agents Act 1980, Section 52 Introduction Form 2, Regulation 7, Estate Agents (General, Accounts and Audit) Regulations 2008 For the purposes of Section

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign statement vendor small business form

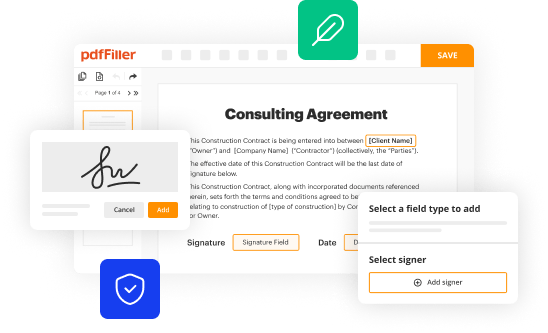

Edit your statement vendor small form online

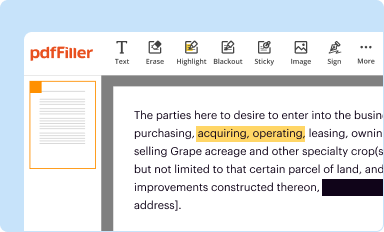

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

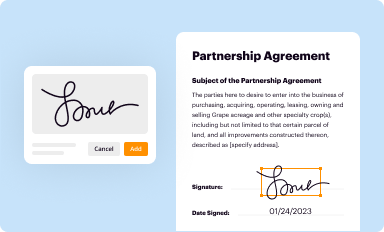

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Statement by a Vendor of a Small Business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Statement by a Vendor of a Small Business online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Statement by a Vendor of a Small Business. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

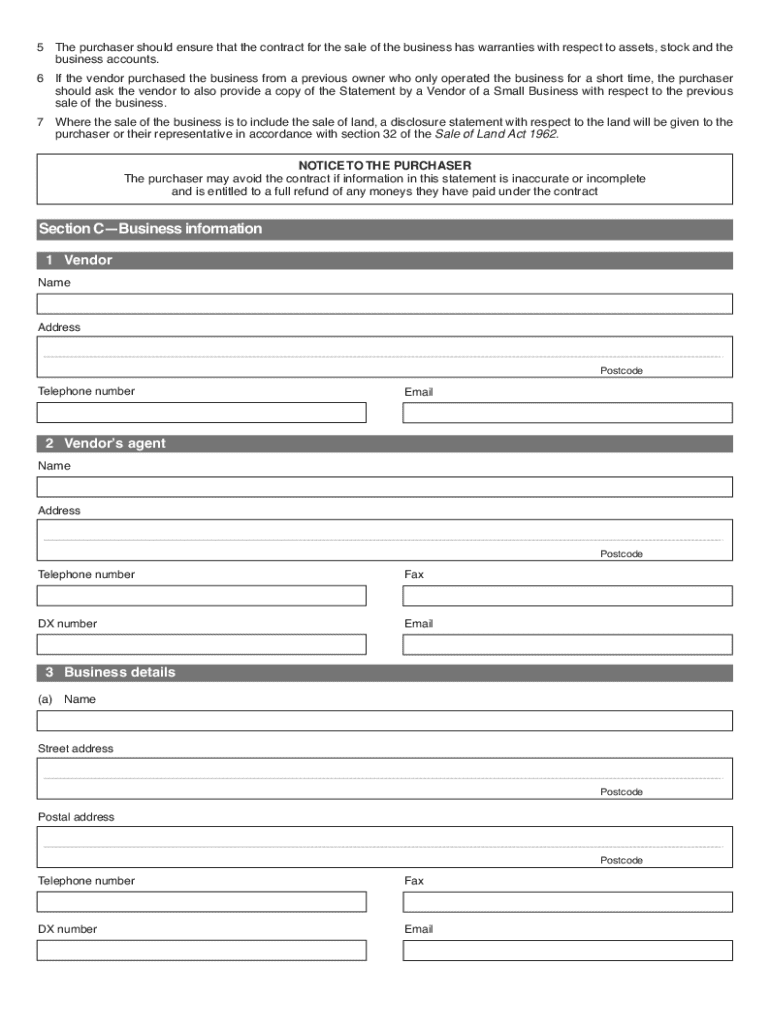

How to fill out Statement by a Vendor of a Small Business

How to fill out Statement by a Vendor of a Small Business

01

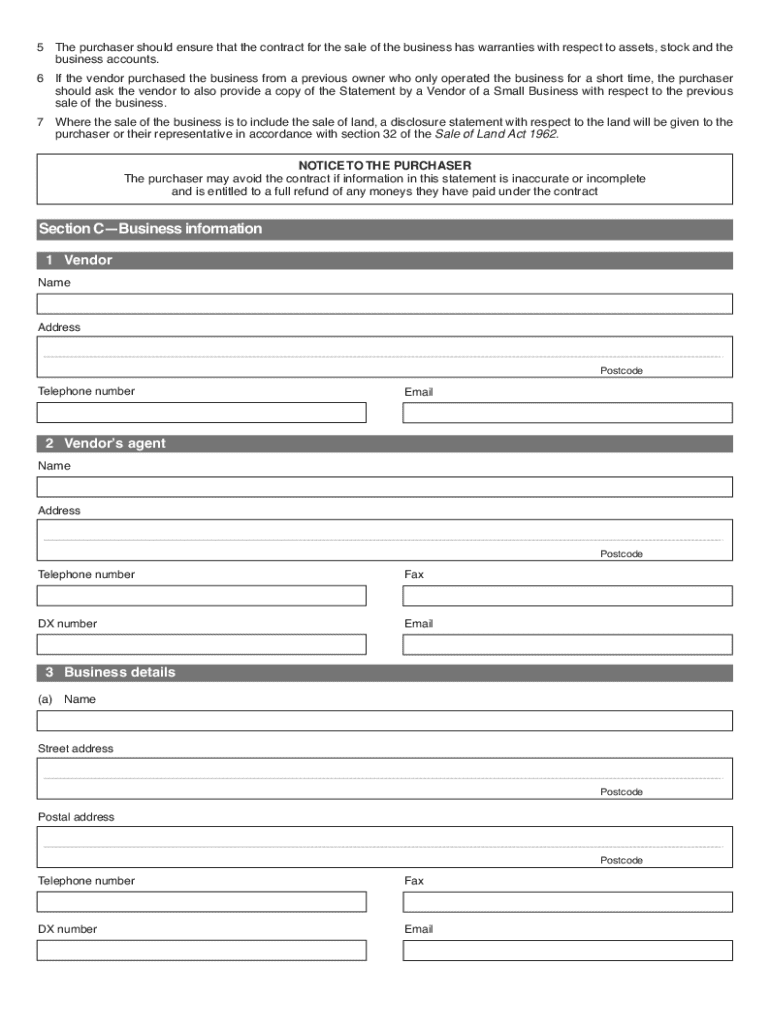

Start with the title 'Statement by a Vendor of a Small Business'.

02

Include the vendor's name and contact information at the top of the document.

03

Add the business's name, address, and contact details.

04

Specify the date the statement is being completed.

05

Clearly state the purpose of the statement, indicating it is a declaration of the vendor's business status.

06

Provide a description of the services or products offered by the vendor.

07

Include information about the vendor's tax identification number.

08

Sign the document with a pen and date it to confirm authenticity.

09

Make copies for your records and send the original to the requesting party.

Who needs Statement by a Vendor of a Small Business?

01

Small businesses seeking to verify their vendor status for tax or compliance purposes.

02

Businesses or individuals requiring documentation for financial transactions or vendor agreements.

03

Accountants and financial institutions needing proof of business operations for audits.

Fill

form

: Try Risk Free

People Also Ask about

What is a vendor form?

What Is a Vendor Application Form? Vendors complete a vendor application form when they apply to sell products or services at a conference, festival, or fair. The form includes vendor names, contact information, tax ID, booth preferences, payment information (if applicable), and details on their offerings.

What is statement of account to vendor?

The statement of account acts as a report issued by a vendor that captures the financial transaction history between two businesses within a specific date range. An invoice, on the other hand, is a bill for a single transaction.

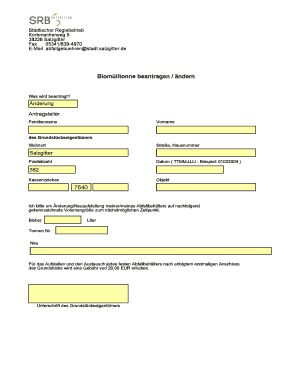

What is a new vendor form?

A new vendor form is a document that details the specific requirements for vendors who will be doing business with a company.

What does statement with vendor mean?

Vendor statements, also known as a section 32, are documents that tell potential buyers what they need to know about a property before signing a contract to purchase. It's a vital part of the buying and selling process and discloses all information that isn't readily available during an inspection.

What is a vendor statement in accounts payable?

What is Vendor Reconciliation in Accounts Payable? The vendor reconciliation process in accounts payable involves identifying discrepancies between vendor invoices and your actual expenses. The procedure entails matching the amount your suppliers and vendors bill your company versus how much you actually owe them.

What is a vendor information request form?

This vendor form typically includes the vendor name, address, invoice number, and payment terms. In addition, this form will reflect the payment details of the vendor or supplier to ensure that vendor payments are completed on time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is statement vendor business?

Statement vendor business refers to a type of business that creates and sells statement products, such as statement clothing, statement accessories, statement home decor, or statement artwork. These products are usually unique, bold, and eye-catching, designed to make a statement or express a particular idea, message, or identity. The business may involve designing and manufacturing these products or curating and selling statement items from other designers or artists. The target market for statement vendor businesses is typically individuals who appreciate and enjoy expressing themselves through fashion, lifestyle, or art.

Who is required to file statement vendor business?

The vendor (business) is required to file a statement.

How to fill out statement vendor business?

To fill out a statement for a vendor/business, follow these steps:

1. Heading: Start by adding a heading at the top of the statement that includes the name and contact information of your business. Include your business address, phone number, and email.

2. Date: Below the heading, write the date of the statement.

3. Vendor/Business Information: Add the name and contact details of the vendor/business you are creating the statement for. Include their company name, address, phone number, and email.

4. Statement Details: Include a section that outlines the details of the statement. This should include the following information:

- Invoice/Statement Number: Assign a unique number to the statement for tracking purposes.

- Statement Date: Mention the specific date for the statement.

- Billing Period: State the duration that the statement covers (e.g., month, quarter, etc.).

- Payment Due Date: Specify the date by which the payment is expected.

- Account Number: If there is a specific account number associated with the vendor/business, include it here.

5. Itemize Charges: Create a detailed list of products, services, or expenses performed by the vendor/business. Include the following columns:

- Description: Describe each item or service provided.

- Quantity: Specify the quantity of each item or service.

- Unit Price: Mention the cost of each item or service.

- Total: Multiply the quantity by the unit price for each item to calculate the total cost.

6. Subtotal: Calculate the subtotal by summing up the total costs of all the items or services provided.

7. Taxes or Additional Charges: If applicable, add any applicable taxes or additional charges to the subtotal.

8. Total Amount Due: Add the subtotal and any additional charges to calculate the total amount due.

9. Payment Instructions: Clearly specify the preferred payment methods (e.g., check, bank transfer) and provide relevant details like recipient's name, bank account number, and any other necessary instructions. If there are specific terms or conditions for payment, include them as well.

10. Contact Information: Provide a contact person or department within your business that the vendor/business can reach out to in case of any questions or concerns.

11. Closing: End the statement with a polite closing, such as "Thank you for your prompt attention to this matter."

12. Signature: Leave some space at the bottom for the authorized representative of your business to sign and date the statement.

Remember to keep a copy of the statement for your records before sending it to the vendor/business.

What is the purpose of statement vendor business?

The purpose of a statement vendor business is to provide services related to creating and distributing customer statements on behalf of other businesses. These services typically involve compiling, formatting, and printing statements that include information such as transactions, balances, and payment details for customers. Statement vendors may also handle mailing or electronic delivery of the statements, as well as provide options for online access or interactive statement viewing. The primary objective of a statement vendor business is to offer efficient and accurate statement generation and delivery services, helping businesses streamline their financial processes and improve customer communication.

What information must be reported on statement vendor business?

When preparing a vendor business statement, the following information is typically reported:

1. Vendor Name: The name of the vendor or supplier.

2. Vendor Address: The physical address or mailing address of the vendor's business location.

3. Vendor Contact Information: Contact details of the vendor, including phone number and email address.

4. Invoice Number: The unique identification number assigned to the invoice or bill sent by the vendor.

5. Invoice Date: The date when the invoice or bill was issued by the vendor.

6. Payment Due Date: The deadline for the payment to be made to the vendor.

7. Description of Goods/Services: A detailed description of the goods or services provided by the vendor.

8. Quantity: The number of units or quantity of goods or services provided.

9. Unit Price: The price per unit of the goods or services provided.

10. Total Amount: The total amount due for the goods or services provided, before any taxes or discounts.

11. Tax and/or Discount: Any applicable taxes or discounts on the goods or services provided.

12. Net Amount: The final amount due after deducting any taxes or discounts.

13. Payment Terms: The agreed-upon terms of payment, such as payment methods, late payment penalties, or early payment discounts.

14. Payment History: A summary of payment transactions made to the vendor, including dates and amounts of previous payments.

15. Account Balance: The outstanding balance of payments due to the vendor.

16. Remittance Information: Instructions on how to make the payment to the vendor, including account details or payment address.

17. Vendor Tax Identification Number: The vendor's tax ID or VAT number, depending on the country or jurisdiction.

It is important to note that specific reporting requirements may vary depending on the jurisdiction, industry, or business agreements between the vendor and the buyer.

How can I modify Statement by a Vendor of a Small Business without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including Statement by a Vendor of a Small Business, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in Statement by a Vendor of a Small Business without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your Statement by a Vendor of a Small Business, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit Statement by a Vendor of a Small Business on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit Statement by a Vendor of a Small Business.

What is Statement by a Vendor of a Small Business?

A Statement by a Vendor of a Small Business is a document required to report certain financial activities and transactions related to small businesses for tax purposes.

Who is required to file Statement by a Vendor of a Small Business?

Vendors and small businesses that engage in transactions requiring the reporting of payment information to the IRS are required to file this statement.

How to fill out Statement by a Vendor of a Small Business?

To fill out the statement, individuals should provide their business information, details of the transactions, and any relevant tax identification numbers, ensuring all information is accurate and complete.

What is the purpose of Statement by a Vendor of a Small Business?

The purpose of the statement is to provide the IRS with information about payments made to vendors which helps in the proper taxation of small businesses.

What information must be reported on Statement by a Vendor of a Small Business?

The information that must be reported includes the vendor's name, address, tax identification number, the amount paid, and the services or goods provided.

Fill out your Statement by a Vendor of a Small Business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Statement By A Vendor Of A Small Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.